mass wage tax calculator

To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Number of Allowances State W4 Pre-tax Deductions 401k IRA etc.

Salary Calculator Salary Calculator Salary Calculator Design

Massachusetts 160k Salary Example.

. Enter your hourly wage - the amount of money you are paid each. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Massachusetts local counties cities and special taxation districts. Check if you have multiple jobs.

That goes for both earned income wages salary commissions and unearned income interest and dividends. See where that hard-earned money goes - Federal Income Tax Social Security and other deductions. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits.

Massachusetts 150k Salary Example. It doesnt matter how much you make. Choose Marital Status Single or Dual Income Married Married one income Head of Household.

Just enter in the required info below such as wage and W-4 information and our tool will perform the necessary calculations. On the next page you will be able to add more details like itemized deductions tax credits capital gains. Massachusetts 120k Salary Example.

Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income. The Massachusetts Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Massachusetts State Income Tax Rates and Thresholds in 2022. So the tax year 2021 will start from July 01 2020 to June 30 2021.

Details of the personal income tax rates used in the 2022 Massachusetts State Calculator are published. Switch to Massachusetts hourly calculator. Massachusetts 170k Salary Example.

New employers pay 242 and new construction employers pay 737 for 2022. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. You can use our Massachusetts Sales Tax Calculator to look up sales tax rates in Massachusetts by address zip code. On the first 15000 each employee earns Massachusetts employers also pay unemployment insurance of between 094 and 1437.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. This contribution rate is less because small employers are not required to pay the employer share of the medical leave contribution. This Massachusetts hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Massachusetts is one of only a few states that has a flat tax system. Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Massachusetts paycheck calculator. As of January 1 2020 everyone pays 5 on personal income.

Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck calculator. Payroll taxes in Massachusetts Massachusetts income tax withholding. More information about the calculations performed is available on the about page.

You can use our free Massachusetts income tax calculator to get a good estimate of what your tax liability will be come April. Massachusetts Income Tax Calculator 2021. Overview of Massachusetts Taxes.

The amount of federal and Massachusetts income tax withheld for the prior year. Number of Qualifying Children under Age 17. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Taxable income Tax rate based on filing status Tax liability. The calculator will automatically assume that the employer takes the maximum possible tip credit and calculate tip and cash wage earnings accordingly. Massachusetts 110k Salary Example.

Use ADPs Massachusetts Paycheck Calculator to calculate net take home pay for either hourly or salary employment. The Massachusetts income tax has one tax bracket with a maximum marginal income tax of 500 as of 2022. Contacting the Department of Unemployment Assistance to fulfill obligations for state employment security taxes.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Massachusetts. Contribution rate split for employers with fewer than 25 covered individuals. Adjusted gross income - Post-tax deductions Exemptions Taxable income.

Massachusetts 180k Salary Example. The total Social Security and Medicare taxes withheld. Filing 5000000 of earnings will result in 429500 of that amount being taxed as federal tax.

Use this hourly paycheck calculator to determine take-home pay for hourly employees in Massachusetts. Massachusetts Hourly Paycheck Calculator. Massachusetts Income Tax Calculator 2021.

After entering it into the calculator it will perform the following calculations. Figure out your filing status. Helpful Paycheck Calculator Info.

- FICA Social Security and Medicare. For unemployment insurance information call 617 626-5075. Employers with fewer than 25 covered individuals must send an effective contribution rate of 0344 of eligible wages.

Massachusetts 130k Salary Example. If you make 80000 a year living in the region of Massachusetts USA you will be taxed 14367. Employers also have to pay a Work Force Training Contribution of 0056 and a Health Insurance Contribution of 5.

Massachusetts 140k Salary Example. Massachusetts allows employers to credit up to 765 in earned tips against an employees wages per hour which can result in a cash wage as low as 435 per hour. Fill in the form and Gusto will crunch the numbers for you.

- Massachusetts State Tax. After a few seconds you will be provided with a full breakdown of the tax you are paying. Massachusetts is a flat tax state that charges a tax rate of 500.

Filing 5000000 of earnings will result in 382500 being taxed for FICA purposes. Total annual income - Tax liability All deductions Withholdings Your annual paycheck.

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Ultimate Guide To German Tax Class And How To Change It Johnny Africa

How To Calculate Income Tax In Excel

Paycheck Calculator Take Home Pay Calculator

Cryptocurrency Tax Guides Help Koinly

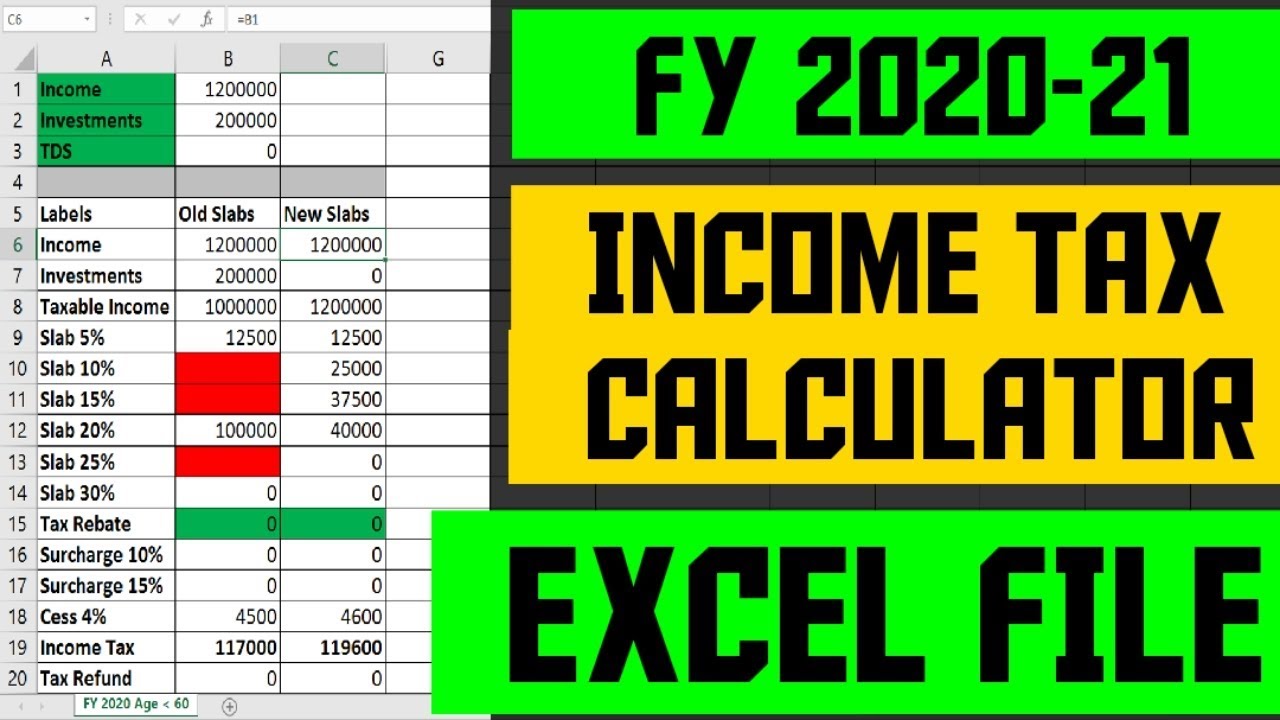

Income Tax Excel Calculator Income Tax Calculation Fy 2020 21 Examples Youtube

Llc Tax Calculator Definitive Small Business Tax Estimator

Massachusetts Paycheck Calculator Smartasset

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Income Tax Rates In Nepal 2079 2080 Corporation Individual And Couple

How Much Should I Set Aside For Taxes 1099

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

How To Calculate Income Tax In Excel

Paycheck Calculator Take Home Pay Calculator

Salary Calculator Salary Calculator Salary Calculator Design

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Paycheck

Income Tax Calculator 2021 2022 Estimate Return Refund

How To Calculate Income Tax In Excel

Income Tax Calculator Estimate Your Refund In Seconds For Free